All Risk vs. Named Peril: A Head-to-Head Comparison

You’ve learned the hard truth that every experienced shipper knows: the “basic” protection included with your shipment is not real insurance. Relying on limited carrier liability is a high-stakes gamble, and it’s one that leaves your business exposed to significant financial loss.

So, you’ve made the smart decision to seek out proper shipping insurance. But as you begin your research, you’re faced with a new set of confusing terms. What’s the difference between “Named Peril” and “All Risk” insurance? How do you know which one actually protects you when something goes wrong?

Choosing the right policy is just as important as deciding to get insured in the first place. This guide will serve as your clear, comparative roadmap. We will break down the three distinct levels of shipment protection – from the inadequate default to the gold standard – so you can see exactly what you are, and more importantly, what you are not, covered for with each option.

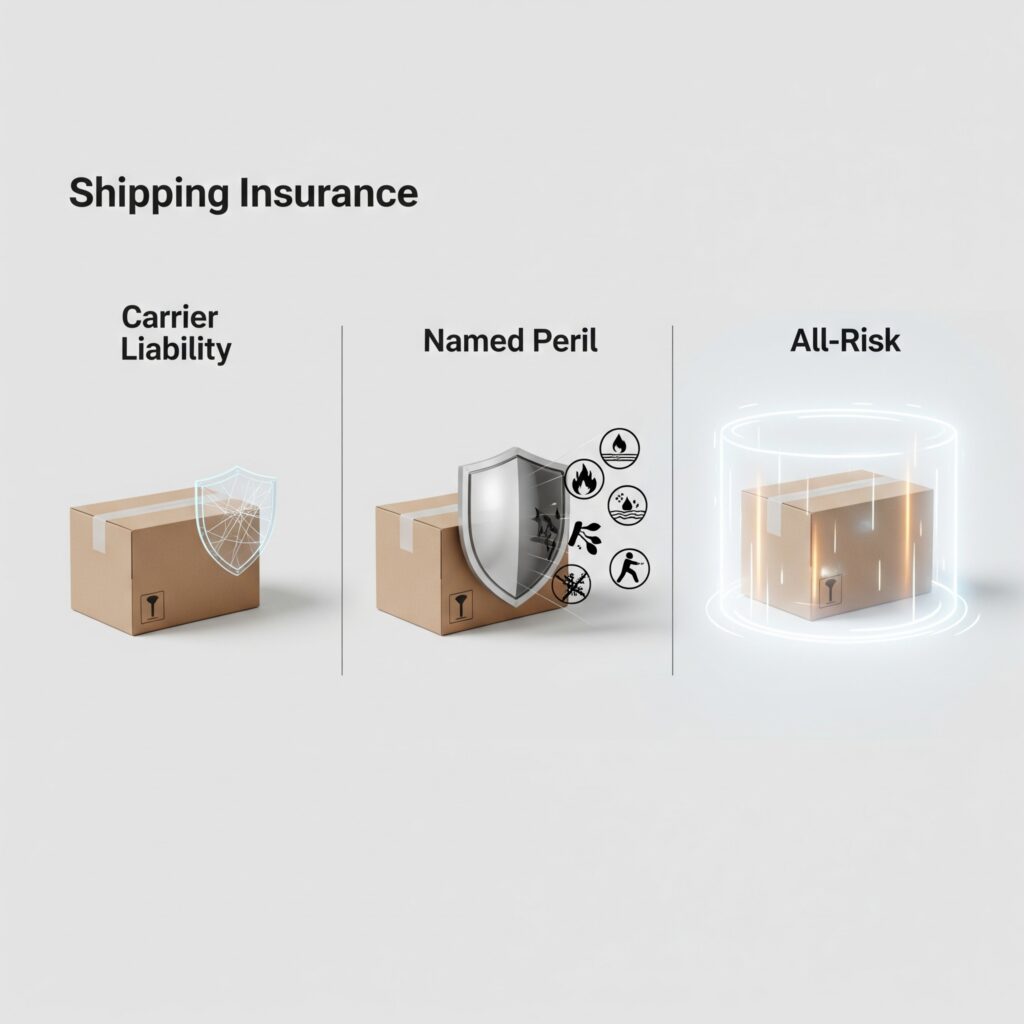

Level 1 (The Default): Basic Carrier Liability

This is the ground floor of protection and, as we covered in our [guide to what happens when shipments are lost or damaged], it’s a shaky foundation.

- What It Is: Not an insurance policy, but a predetermined, minimal level of financial responsibility that a carrier accepts for the goods they transport.

- How It Covers You: Coverage is extremely limited. You are typically only eligible for a payout if you can definitively prove that the loss or damage was a direct result of the carrier’s own negligence.

- The Payout: The reimbursement is based on the package’s weight, not its value (typically $2/lb in Canada). For a lightweight, high-value item like a laptop or designer handbag, the payout would be a tiny fraction of its actual worth.

- The Biggest Risk: It leaves you completely unprotected against the most common issues. There is generally no coverage for “Acts of God” (like a flood or tornado), theft from a vehicle if the driver was not deemed negligent, or mysterious disappearances where fault cannot be proven.

- The Verdict: Carrier liability is not a viable protection strategy for any business shipping valuable goods. It’s a safety net made of giant, gaping holes.

Level 2 (The Basic Upgrade): Named Peril Insurance

Moving up a level, some third-party providers offer a basic form of coverage called “Named Peril” insurance. While better than relying on the carrier, this option comes with its own significant risks hidden in the fine print.

- What It Is: An insurance policy that only covers losses from a specific list of risks – or “perils” – that are explicitly named in the policy document.

- How It Covers You: If the cause of your loss is on the list, you’re covered. This list typically includes major events like a fire, an earthquake, or the transport vehicle being involved in a collision.

- The Payout: If covered, the payout is for the declared value of your goods.

- The Biggest Risk (The Fine Print): The danger lies in what is not on the list. If your loss is caused by anything other than one of those specifically named perils, you receive nothing. Many of the most common, realistic shipping mishaps are often excluded.

Examples of what a Named Peril policy may not cover:

- Water Damage: The policy might cover flood, but not damage from a leaky roof on the delivery truck or a package left in the rain.

- Theft: It might cover the theft of the entire truck, but not the more common scenario of a package being stolen from inside the vehicle.

- Accidental Damage: It often doesn’t cover accidental drops or damage caused by improper sorting at a carrier facility.

- Mysterious Disappearance: If a package simply vanishes from the tracking system with no explanation, it’s often not covered as there is no specific, named event to point to.

- The Verdict: Named Peril insurance is a gamble. It creates a false sense of security while leaving you exposed to numerous common risks. You are betting that if a problem occurs, it will be one of the few specific types listed in your policy.

Level 3 (The Gold Standard): All Risk Shipper’s Interest Insurance

This is the highest level of protection available and the only one truly designed for the unpredictable nature of shipping. It operates on a fundamentally different and more powerful principle than Named Peril policies.

- What It Is: A comprehensive, first-party insurance policy that is designed to cover your shipment against any and all external causes of loss or damage.

- How It Covers You: The coverage principle is reversed. An “All Risk” policy is assumed to cover your loss unless the cause is specifically listed as an exclusion in the policy document. This shifts the burden of proof from you to the insurance company.

- The Payout: Provides full coverage for the declared value of your goods, protecting your revenue and profit margin.

- What Are the Exclusions? Transparency is key. All Risk policies are not “any risk” policies, but the exclusions are typically limited, predictable, and often related to factors within the shipper’s control. Common exclusions include:

- Improper or Insufficient Packing: Damage resulting from the goods not being packed securely enough for transit.

- Inherent Vice: Loss due to the natural properties of the goods themselves (e.g., fresh produce spoiling, iron rusting).

- Catastrophic events like acts of war, nuclear incidents, or government seizure.

- The Verdict: All Risk Shipper’s Interest Insurance is the gold standard for businesses. It provides the broadest form of protection available, covering the vast majority of real-world shipping incidents, from theft and accidental damage to mysterious disappearance. It is the only policy that provides true peace of mind.

Scenario Comparison: All Risk vs. Named Peril

| Scenario | Named Peril Coverage? | All Risk Coverage? |

| Package dropped & broken by carrier staff | Likely No (Not a listed peril) | Yes |

| Package stolen from a delivery truck | Maybe (Only if “theft” is named) | Yes |

| Water damage from a leaky truck roof | Likely No (Not a “flood”) | Yes |

| Shipment vanishes from tracking | No (No specific peril to claim) | Yes |

Why Settle for Partial Protection?

Choosing a Named Peril policy over an All Risk policy is like buying home insurance that only covers fires on Tuesdays. It might feel like you’re saving a few dollars on the premium, but you’re left with a dangerous illusion of security. The small difference in cost between a basic policy and a comprehensive All Risk policy is insignificant compared to the massive difference in coverage and financial risk you are taking on.

Your business, your products, and your customer relationships are too valuable to be left to chance.

Conclusion: Don’t Gamble With Your Shipments

The decision about your shipping insurance is more than just a line item on a freight invoice; it’s a direct reflection of your company’s approach to risk, customer service, and financial foresight. Choosing a protection plan is not simply about ticking a box – it’s about consciously deciding what level of uncertainty you are willing to accept for your business.

When you look at the options through this lens, the choice becomes clear:

- Carrier Liability: The default gamble. This is a passive acceptance of immense risk, relying on hope as a strategy because there is virtually no recourse when something goes wrong.

- Named Peril Insurance: A calculated risk with hidden loopholes. You are betting that a loss will only occur from a small list of pre-approved causes, leaving you exposed to many common and costly mishaps.

- All Risk Insurance: The professional strategy. This represents a conscious decision to eliminate uncertainty, providing the comprehensive, secure coverage that protects your revenue, your reputation, and your peace of mind.

A single uninsured loss can have a domino effect, costing you not just the value of the goods, but the trust of your customer and the time your team wastes fighting a losing battle for a minuscule payout. Your business deserves complete protection, not a policy filled with exceptions that creates a false sense of security.

The next step is to replace that uncertainty with data. See for yourself how affordable and accessible comprehensive protection really is.

See how affordable true peace of mind can be.

–> Get Your Instant Quote for All Risk Shipper’s Interest Insurance Now

Still have questions about the right coverage for your specific products? Our team is here to help you navigate your options.

–> Contact an Insurance Expert Today

Additional Resources

- International Risk Management Institute (IRMI) – All Risks Coverage Definition

https://www.irmi.com/term/insurance-definitions/all-risks-coverage- The IRMI is a leading authority on risk and insurance. This page provides a technical, authoritative definition of “All Risks” coverage, confirming the concepts discussed in our guide.

- The Hartford – Named Peril vs. All-Risk Business Insurance

https://www.thehartford.com/business-insurance/named-peril-vs-all-risk- While focused on general business property, this article from a major insurance company clearly explains the fundamental difference between the “named peril” and “all-risk” insurance models.

- Investopedia – Inherent Vice Definition

https://www.investopedia.com/terms/i/inherent-vice.asp- To help readers understand common exclusions, this article provides a clear definition of “inherent vice,” one of the few things not covered by an All Risk policy.