Analyzing Your CIF Insurance Coverage: A Guide for Businesses

Your supplier has agreed to CIF (Cost, Insurance, and Freight) terms for your latest international shipment, and on the surface, the deal seems perfect. The price includes the cost of your goods, the freight charges to a Canadian port, and, most reassuringly, an insurance policy. With that “I” for insurance seemingly checked off, it’s easy to file the agreement away and assume your shipment is fully protected against the perils of its long journey.

But what if that included insurance policy contains more gaps than coverage?

As a business owner, you’ve moved past the basics. You know what CIF stands for, but now you’re asking the more sophisticated questions that separate amateur importers from professionals. You’re asking, “What am I really covered for? Is my CIF insurance coverage actually enough to protect my business if something goes wrong?”

This guide will dissect the standard insurance provided under CIF terms. We will expose the five most significant risks it leaves wide open—risks that can lead to catastrophic financial loss. Most importantly, we will provide you with a clear, actionable formula for calculating the Total Insurable Value your business needs to be truly and completely protected, no matter how you ship.

A Closer Look at the “I” in CIF: Minimum Coverage by Design

The first thing to understand is that the seller in a CIF agreement has a primary motivation: to fulfill their contractual obligation at the lowest possible cost. The Incoterms rules only require them to provide a minimum level of insurance coverage. This is rarely a premium, comprehensive plan.

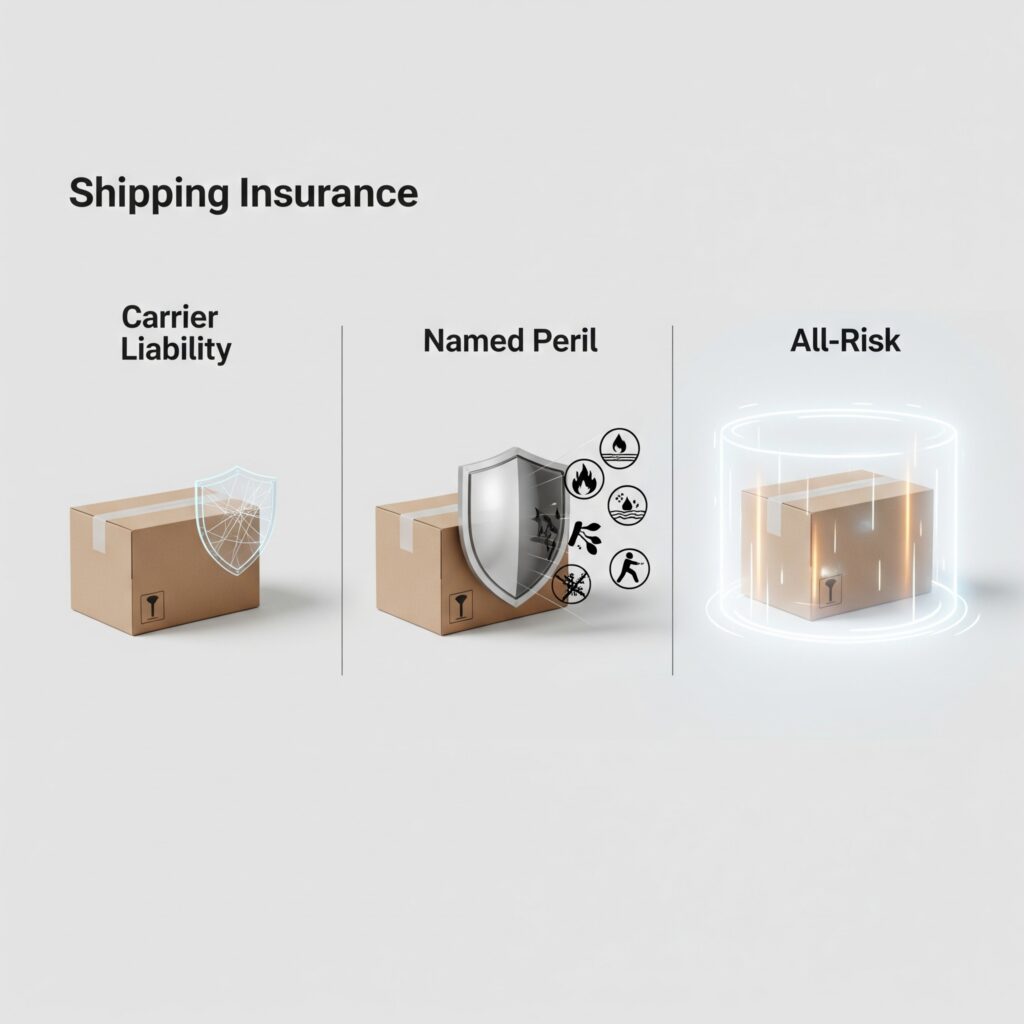

Often, the policy provided is equivalent to the Institute Cargo Clauses ‘C’, which is one of the most basic forms of “Named Peril” insurance. A Named Peril policy is exactly what it sounds like: it only covers losses from a specific, very short list of major events, or “perils,” that are explicitly named in the policy document.

Think of it this way: it’s like buying home insurance that only covers you if your house is damaged by a meteor, but not by a fire, a flood, or a break-in. It technically qualifies as “insurance,” but it fails to cover the most common and realistic risks. The seller has met their obligation, but you, the business owner, are left with a false sense of security.

The 5 Hidden Risks in Standard CIF Insurance

When you rely on the minimal policy included in a CIF agreement, you are exposing your business to five significant and often overlooked risks.

Risk #1: The “Named Peril” Gamble – Coverage Full of Loopholes

The fundamental weakness of standard CIF insurance lies in its “Named Peril” structure. As mentioned, it only covers a short list of major catastrophic events. The problem is that most freight losses don’t happen because a ship sinks; they happen due to common, everyday mishaps.

This is where the gold standard of insurance, “All Risk” coverage, is fundamentally different. An All Risk policy works on a reverse principle: it covers your shipment against any and all external causes of loss or damage, unless the cause is on a short, specific list of exclusions (like improper packing by the shipper or acts of war).

Let’s compare them in a few real-world scenarios:

| Scenario | Standard CIF “Named Peril” Coverage? | Comprehensive “All Risk” Coverage? |

| Forklift Damage: Your container is accidentally dropped while being unloaded at the port. | No. This is not on the list of named perils like “sinking” or “fire.” | Yes. This is an external cause of damage and is covered. |

| Theft from Container: Thieves break the seal and steal half the items from your container at the terminal. | No. The policy may cover the entire vessel being stolen, but not partial theft from a single container. | Yes. Theft is covered. |

| Water Damage from Rain: Your container is left open to the elements during a storm at the port, and your goods are ruined. | No. This is not a “peril of the seas” like a tsunami. | Yes. Accidental water damage is covered. |

| Mysterious Disappearance: Your shipment is scanned into a terminal but then vanishes. There’s no proof of what happened. | No. Without a specific, named peril to point to, you cannot make a claim. | Yes. Mysterious disappearance is typically covered under All Risk policies. |

Export to Sheets

Relying on a Named Peril policy is a dangerous gamble. You are betting that if something goes wrong, it will just happen to be one of the few covered events.

Risk #2: The Geography Gap – Your Insurance Ends at the Port

This is a critical, geographical gap in coverage. A seller’s obligation under CIF is to deliver the goods and the insurance policy to the destination port. For a Canadian business, that means the insurance coverage they purchased likely expires the moment your container is safely offloaded at the Port of Vancouver, Montreal, or Halifax.

Consider the full journey of your goods: Overseas Factory -> Origin Port -> Ocean Voyage -> [COVERAGE ENDS HERE] -> Destination Port -> Domestic Truck/Rail -> Your Final Warehouse

This leaves the final and often riskiest leg of the journey completely uninsured by the CIF policy. The risk of road accidents, theft from a truck at a rest stop, and handling damage at domestic sorting facilities is high, and under CIF, that risk is entirely yours.

Risk #3: The Financial Gap – You’re Not Covered for Your Full Costs

Let’s assume a best-case scenario with your CIF insurance: a covered peril occurs, and your claim is approved. The policy will reimburse you for the declared value of your goods. However, it will not reimburse you for the thousands of dollars in non-refundable freight charges you paid as part of the CIF price.

If a shipment is declared a total loss, you don’t just lose the value of the product; you also lose the entire shipping cost. A $30,000 shipment with $4,000 in freight charges becomes a $34,000 total loss, but the CIF insurance will only ever cover the $30,000. That $4,000 comes directly out of your pocket.

Risk #4: The Claims Nightmare – You’re on Your Own

When your goods are damaged or lost at sea under a CIF agreement, you, the buyer, are the one who has to file the claim. This means you must navigate a complex claims process with an overseas insurance company that was chosen by your supplier.

You will likely face time zone differences, potential language barriers, and a bureaucratic process with a company you have no existing relationship with. It can take months of frustrating follow-up to get a resolution, with little transparency along the way. This is a massive administrative headache that pulls you away from running your actual business.

Risk #5: The Hidden Costs – The Dangers of Under-Insurance

In maritime law, there is a principle called “General Average.” If a ship’s captain must make an emergency decision to sacrifice some cargo (for example, jettisoning containers to save the vessel in a storm), all the other parties with cargo on that ship must proportionally contribute to the loss. If the minimal CIF insurance on your goods doesn’t meet the required value for the General Average claim, you could be held personally liable to help cover the losses of other companies’ cargo. It’s a rare but devastating risk of being under-insured on the open seas.

The Solution: Calculating Your True “Total Insurable Value”

After seeing these risks, it’s clear that relying on standard CIF insurance coverage is not a sound business strategy. The solution is to secure your own comprehensive, All Risk policy that covers your shipment for its Total Insurable Value.

The principle is simple: the goal of insurance is to be made “financially whole” again after a loss. To do that, you must insure not just the value of your product, but your entire financial stake in the shipment, which includes the non-refundable shipping costs.

The formula is straightforward: C (Cost of your Cargo/Product) + F (Cost of the Freight) = Your Total Insurable Value (TIV)

Let’s apply this universal formula to a few scenarios:

- The Importer (Ocean Freight): You are importing a container of electronic components from Taiwan, purchased on CIF terms.

- Cost of Cargo (C): $50,000

- Cost of Freight (F), included in CIF price: $5,000

- Your Total Insurable Value is not just $50,000. It’s $50,000 + $5,000 = $55,000. This is the amount you need to insure to be made whole.

- The Domestic Manufacturer (Truck/Rail): You are a business in Brantford, Ontario, shipping a pallet of finished goods to a major retailer in British Columbia.

- Cost of Goods (C): $8,000

- LTL Freight Cost (F): $650

- Your Total Insurable Value is $8,000 + $650 = $8,650.

- The E-commerce Seller (Courier): You are shipping a custom-made piece of high-value jewelry to a client in the United States.

- Sale Price of Item (C): $2,500

- Express Shipping Cost (F): $90

- Your Total Insurable Value is $2,500 + $90 = $2,590.

How ShipSimple Provides Complete, Door-to-Door Protection

Understanding your Total Insurable Value is the first step. The next is finding a simple way to secure coverage for that amount. This is where the ShipSimple platform bridges the gap.

With ShipSimple, you can easily purchase a single, comprehensive, All Risk insurance policy that covers your calculated Total Insurable Value. Our policies are designed to cover your shipment’s entire journey—from the seller’s door all the way to your door—rendering the inadequate CIF insurance obsolete and closing all five of the risks we’ve identified. You get one policy, one simple claims process managed here in Canada, and complete peace of mind.

Conclusion: Move Beyond Minimums to Total Protection

Here in 2025, relying on the standard CIF insurance coverage included in a sales agreement is a significant and unnecessary business risk. It is a bare-minimum policy designed to satisfy a contractual term, not to fully protect your investment. Smart businesses take control. They understand the critical difference between the minimal coverage sellers provide and the comprehensive protection they actually need. By calculating their Total Insurable Value and securing a single, All Risk policy, they transform a risky transaction into a secure investment.

Don’t guess if you’re protected. Know you are.

–> Get Your Instant Quote for Comprehensive All Risk Insurance Now

Additional Resources

- International Trade Administration – Incoterms® Overview

https://www.trade.gov/incoterms-2020- An official resource from the U.S. Department of Commerce that provides clear, authoritative definitions and guidance on Incoterms, including CIF.

- The Insurance Institute of Canada – Cargo and Marine Insurance Resources

https://www.insuranceinstitute.ca/en/resources/insights-research/cargo-and-marine- This resource page from Canada’s national insurance education body provides articles and insights into the principles of cargo and marine insurance, offering an authoritative Canadian perspective on the different clauses and levels of coverage available.

- Business Development Bank of Canada (BDC) – Mitigating Supply Chain Risks

https://www.bdc.ca/en/articles-tools/operations/purchasing/how-to-mitigate-supply-chain-risks- This practical guide from the BDC—Canada’s bank for entrepreneurs—provides actionable advice on how business owners can identify and manage risks within their supply chains, directly supporting the need for proactive measures like comprehensive insurance.