Manufacturing & Industrial

Shipping Insurance

Because you're not just shipping - you're delivering uptime, precision, and production schedules.

You’re moving CNC machinery, robotics, heavy-duty compressors, or electrical control systems – often worth six figures and critical to production.

One dropped pallet, lost component, or late delivery can halt operations, break SLAs, and bleed revenue.

ShipSimple offers specialized All Risk Shipper’s Interest Insurance coverage up to $250,000 (Parcel) $500,000 (Freight), for industrial and manufacturing cargo requiring premium protection. Trusted by suppliers, integrators, and fabricators across North America.

Shipping Industrial Equipment Shouldn’t Risk Downtime

Eliminate The Risk

Every shipment is a link in your production chain. Miss one – and you’re facing missed deadlines, idle workers, or contract penalties. Standard shipping insurance doesn’t understand the stakes. ShipSimple does.

The Risk:

❌ Lost or stolen shipments with no reimbursement

❌ Delays that stall production

❌ Complex, slow claims processes

❌ Insurance providers that don’t “get” B2B logistics

How We Help

ShipSimple specializes high-value, fragile shipments – just like yours. Whether you’re a luxury jeweler, watch retailer, or private seller, our specialized insurance protects your pieces in transit from loss, theft, or damage. So your reputation, revenue, and customer experience stay intact.

What We Offer:

✅ Full coverage up to $250,000 (parcel) $500,000 (freight) per shipment

✅ Fast and fair claims

✅ Coverage for local, national, and international shipments

✅ No paperwork hassle – just a few clicks to insure

✅ Support from people who know industrial logistics

✅ Click here for packaging tips for heavy-duty equipment

All Risk Shipper's Interest Insurance

ShipSimple specializes in All-Risk Shipper’s Interest Insurance, which is a comprehensive type of parcel, cargo / freight shipping insurance designed to protect the shipper’s (cargo owner’s) financial interest in their goods during transit, regardless of who is at fault for loss or damage.

Here’s what it means to you:

“All-Risk” Coverage: This is the broadest form of protection available. Essentially, it covers all physical loss or damage to your goods from any external cause, unless that cause is specifically excluded in the policy. Common exclusions usually involve things like improper packaging, acts of war, government seizures, or inherent defects in the goods themselves.

“Shippers Interest”: This part is key. It means the policy directly protects you, the owner of the cargo. This is a big difference from the basic insurance a carrier (like a trucking company or shipping line) has. A carrier’s liability insurance typically only pays out if they were negligent, and often has very low limits. Shippers interest insurance, however, pays you directly, regardless of who was at fault, and usually covers the full declared value of your goods.

How it Works:

Instant Quotes

Create Account

Process Insurance

Certificate Issued

Policy Activated

Why Manufacturers Trust ShipSimple

Whether you’re shipping an automated press or a replacement gearbox, you’re not just moving freight – you’re moving timelines, output, and deliverables. We insure industrial cargo with real consequences attached.

- Built for Heavy, High-Stakes Shipments

We cover everything from factory robotics and material handling systems to HVAC equipment, motors, and machine tools.

- Backed by the Best in the Business

We partner with CNA, one of the largest U.S. commercial insurers serving Canada, the U.S., and Europe. Your shipments are protected by an elite, globally trusted name in insurance.

- Industry-Leading Coverage & Financial Strength

Rated A by AM Best and A by Standard & Poor’s, our policies reflect the strongest financial stability in the insurance world. That means your payouts are reliable, fast, and safe.

- Flexible Limits for Growing Shipments

Standard $250K (Parcel) / $500K (Freight), with custom programs for larger installations or multi-stop shipments.

- Global Coverage with Trusted Carriers

We work with all major couriers, ensuring your shipments are insured whether they’re going across the city or across the ocean.

- Designed for OEMs, Fabricators, Integrators & Plant Ops

Whether you’re sourcing from abroad or delivering to a production line, our platform is built to support your industry.

- Simple, Instant Quotes — No Red Tape

Skip the phone calls and paperwork. Insure your art shipment in less than 2 minutes, 100% online.

ShipSimple Insurance vs. Standard Carrier Liability

For manufacturers and industrial businesses, every shipment, whether raw materials, components, or finished machinery, is vital to your production schedule and client commitments. Protect your high-volume, high-value movements with ShipSimple’s specialized insurance.

| Feature | ShipSimple | Standard Carrier Liability | Why This Matters for Your Freight |

| Coverage Limits | Up to $250,000 for Parcels, Up to $500,000 for Freight | Typically $2/lb – $25/lb (often max $5000 per shipment) | Large Shipments: Crucial for protecting entire pallets, containers, or heavy machinery that far exceed standard carrier limits. |

| Coverage Type | All-Risk Shipper’s Interest (Covers Most Perils) | Limited Perils (Covers only specific, few events) | Comprehensive Protection: Safeguards against a wider range of incidents, from transit damage to unforeseen disruptions impacting heavy equipment. |

| Deductibles | None for Parcel | Applicable | Cost Efficiency: Reduces out-of-pocket expenses, especially for frequent, smaller claims on components or samples. |

| Claim Process | Fast, Easy, No Red Tape! | Slow, Complex, High Burden of Proof | Production Continuity: Quick payouts mean faster replacement of materials or machinery, minimizing costly production delays. |

| Proof Required | Simple Online Reporting | Extensive Documentation & Investigation | Operational Efficiency: Less administrative burden, allowing your team to focus on production and large-scale logistics. |

| Payer | Backed by CNA (A-rated Global Insurer) | Carrier (Internal Process) | Financial Stability: Guarantees reliable reimbursement from a strong, reputable insurer, essential for managing large-scale inventory. |

| Applicability | Covers All Major Carriers (Multi-Carrier) | Limited to Specific Carrier | Integrated Logistics: Works with all your chosen freight and parcel carriers, simplifying your insurance management. |

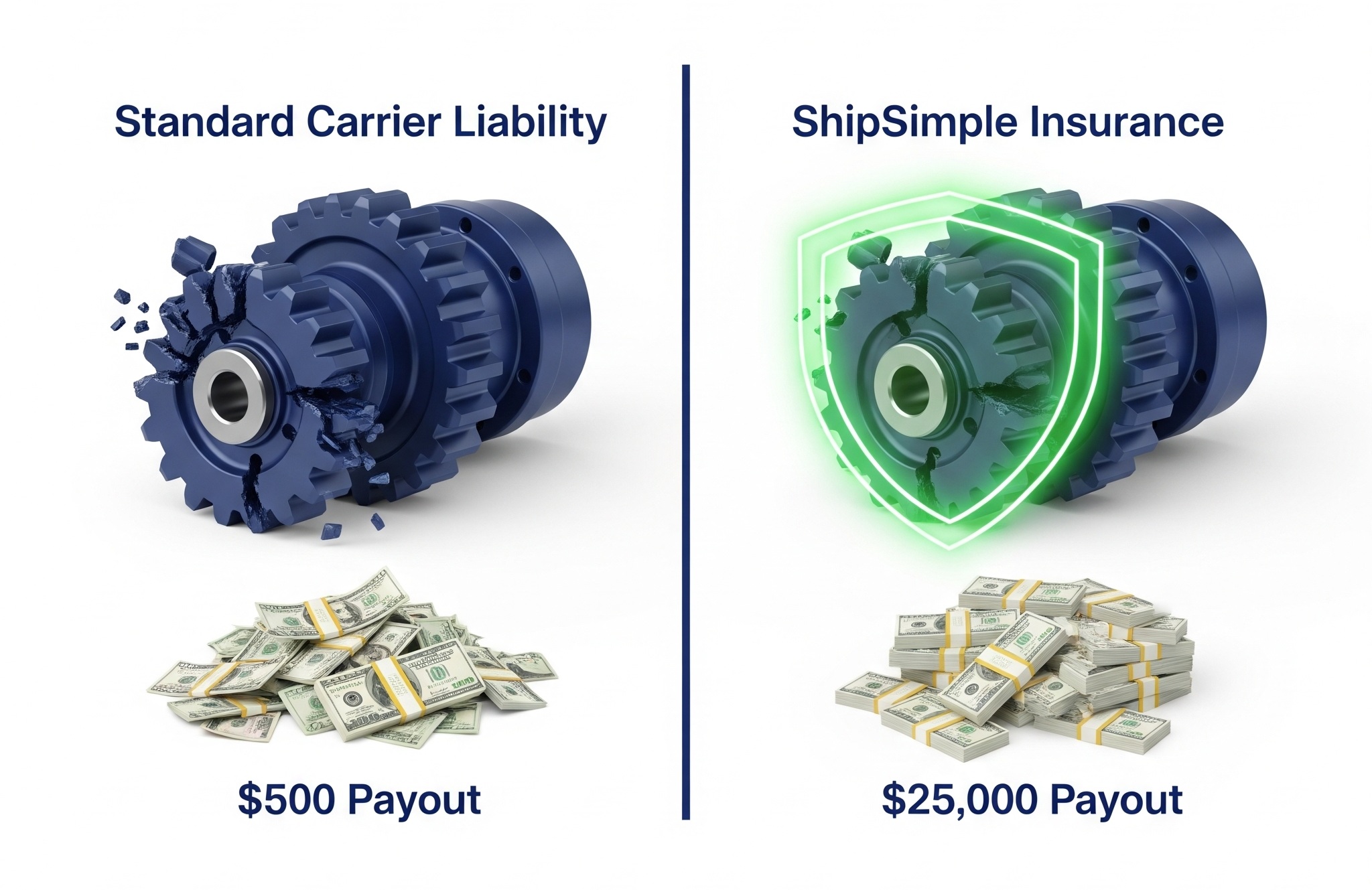

Cost-Benefit Analysis: The Value of Shipment Protection

With ShipSimple Freight Insurance:

Your payout would be the full $25,000 (minus any applicable deductible), ensuring full financial recovery.

With Standard Carrier Liability:

A total loss of a $25,000 shipment would result in a payout of as little as $500, leaving your business to absorb a catastrophic loss of over $24,000.

5 Star Reviews

Speak for themselves — check out what other businesses are saying!

FAQ's

What types of industrial equipment do you insure?

We cover heavy machinery, automation systems, control cabinets, compressors, HVAC units, power tools, robotics, packaging systems, and more.

Can I insure oversized freight?

Yes – we insure LTL, FTL, and specialized freight. For oversize loads, contact us to tailor coverage.

Can I insure a shipment I already sent?

Coverage must be in place before pick-up or carrier acceptance. Plan ahead to ensure you’re protected.

Can I use my own courier/carrier?

You sure can! We provide insurance for shipments created with Canada’s top couriers, including Canada Post, Purolator, GLS, Loomis, and more. Click here to see the full list of approved couriers. If you don’t see your preferred courier, no problem! Just reach out to us, and we’ll work with you to coordinate coverage.

Is there a deductible or additional fees involved?

For parcel coverage, there are no deductibles, additional fees, or service charges. What you see is what you pay.

For freight coverage, a deductible may be applicable at the time of your claim and is dependent on the type of product/item you are shipping.

Please contact insurance@shipsimple.cafor details.

Can I insure international shipments?

Yes, we cover both domestic and international shipments!

International coverage is highly recommended, as there are more touchpoints and potential risks when shipping across borders. Protect your goods and your business with peace of mind.

Are there items that can not be insured?

Some items are excluded from coverage, while others require prior approval.

Excluded Commodity:

These can not be insured

- Live Plants or Animals (including reptiles, snakes, birds, insects,etc.)

- Bullion, Currency, Money, Securities, Accounts, Bills, Deeds, Evidence of Debt, Notes, Stamps, Bonds, Gift cards, etc.

- Precious Metals (gold, silver, etc. in forms of ingots, bullion, coins, etc.) Human remains (including ashes)

- Medical Samples and/or biological products/diagnostic specimens, blood, blood products, plasma, embryos, human or animal specimens or tissues, urine, bodily fluids.

- Ammunition and/or Explosives of any type

- Counterfeit, Illegal or Pirated goods or material Any item(s) the carriage of which is prohibited by any law, regulation or statute of any federal, state or local government to or through which the shipment may be carried.

- Firearms

- Industrial Diamonds / Carbons; Gems, Gemstones, Furs and Statuary Perishable items

- Pharmaceuticals Temperature controlled items

- Automobiles/Trucks/Vans/Motorcycles/ATVs (Commercial Transaction) Industrial/Commercial/Heavy Machinery and Equipment

- Precious Metals and Stones (including unfinished Jewellery)

- Cannabis

Restricted Commodity:

These may be insured with prior approval and conditions:

- Alcoholic Beverages

- Dangerous Goods

- Prescription Medication

- Tobacco Products

- Personal Effects

What does shipping insurance cover?

Our shipping insurance protects your goods against loss, theft or damage while in transit. We offer coverage up to $250,000, one of the highest limits in the industry.

Where can I see details about your coverage and policy?

Yes, we cover both domestic and international shipments!

International coverage is highly recommended, as there are more touchpoints and potential risks when shipping across borders. Protect your goods and your business with peace of mind.

How do I file a claim?

Filing a claim is as easy as purchasing insurance! Just click ‘File a Claim’ next to the shipment or policy in your account, provide the required information, and hit submit. We’ll take care of the rest.

Protect Your Shipment Today

Get a Quote or speak to one of our experts about your shipping insurance coverage, click below

Blog

The 5 Hidden Risks of International Shipping (And Why Carrier Liability Isn’t Enough)

The Reality of International Shipping: Why Your Cargo Is at Risk Global logistics is a modern miracle, but for the package itself, it is a gauntlet of risk. When you hand off an international shipment, you are sending your inventory into a complex, high-friction...

Get All-Risk Shipping Insurance: The 7-Point ShipSimple Advantage

You have done the essential, foundational research. You’ve journeyed from understanding the gauntlet of hidden risks in shipping to a definitive, head-to-head comparison of your protection options. You now know, with absolute certainty, that comprehensive "All-Risk...

Carrier Liability vs All-Risk Insurance: The 7-Point Definitive Comparison

In our previous guide, we uncovered the hidden financial risks of shipping. You learned that the default "coverage" offered by carriers is not true insurance, but a system of limited liability that can leave your business exposed to devastating losses. You've had the...